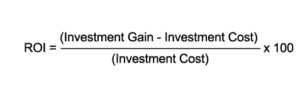

Companies make investments in order to increase their profits over time. One such investment is enterprise software. And many enterprise software vendors provide some sort of Return on Investment (ROI) calculator tool for their prospects to help them determine how much value the software will provide for them. This value may consist of increased revenues and/or reduced costs. This ROI calculator tool helps to justify the financial outlay that would be made to purchase the software. So far so good. This is pretty standard business school 101 practice.

Extensible Software Options

But what if the enterprise software being considered is extensible? According to Wikipedia, “In software engineering, extensibility (not to be confused with forward compatibility) is a system design principle where the implementation takes future growth into consideration...Extensions can be through the addition of new functionality or through modification of existing functionality.” So to paraphrase, a prospect may in the future gain incremental value from the software in exchange for some incremental cost. They will have the opportunity or the right, but not the obligation to take advantage of this additional value. That’s a real option, which is like a financial call option. And Real Options have value.

There are a variety of ways to quantitatively calculate real option value, which are beyond the scope of this blog article.

Instead, let’s think about real options qualitatively in the context of extensible enterprise software:

Creation: One or more real options are created when extensible enterprise software is purchased.

Value: Each of these real options are opportunities to create additional value in the future. These values can be estimated like financial call options.

Delay: Exercising these real options can be delayed, and delaying helps provide additional valuable information (for example: learning more about the full capabilities of the purchased extensible enterprise software).

Irreversible: Once these real options are exercised, they are not reversible.

All in all, Real Options provide a much more flexible and accurate framework for analyzing the purchasing of extensible enterprise software as compared to a simple ROI calculation. And this flexibility stems from the nature of the extensible enterprise software itself. Some valuable investment decisions can be delayed and taken advantage of in the future.

Interested in learning more? Enter your email address below to subscribe to our blog!